Decarbonize Steel Production

Environmental Defense Fund

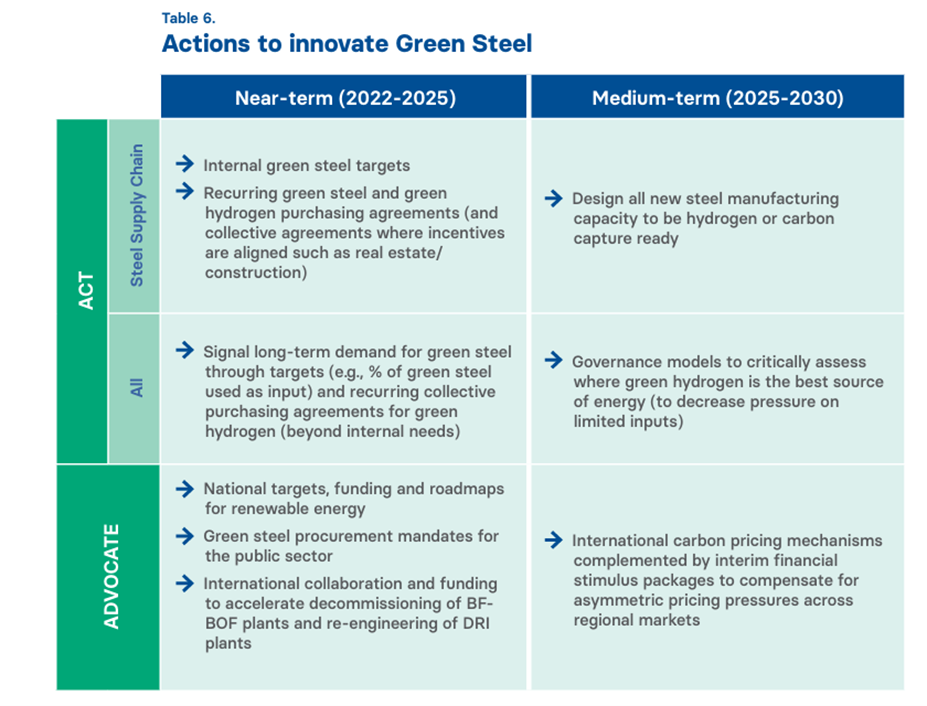

Steel producers and buyers can drive meaningful progress by seizing near-term opportunities, prioritizing low-emission steel in procurement, and supporting industry-wide collaboration and advocacy. These actions not only accelerate decarbonization but also improve efficiency, reduce costs, and position companies to meet growing market and regulatory demands for cleaner industrial materials.

The steel industry accounts for about 7% of global CO2e emissions.1 These emissions mainly come from the traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) steelmaking processes, which rely heavily on coal to generate heat and use coke, a key input in the chemical reactions to refine iron ore into steel. Finding alternatives to the BF-BOF route is therefore critical, especially when more than 70% of the global coal-based furnace capacity will reach the end of its working life by 2030.2 This presents an opportunity for companies to invest in low-emission production technologies.

The World Resources Institute (WRI)’s State of Climate Action report estimates that, to decarbonize the economy, the carbon intensity of global steel production needs to decline by about 29% by 2030 compared to 2020.3

The following steps outline how your company can contribute to this shift.

Understand Your Steel Emissions Footprint and Set Goals

The first step that your company can take is to conduct a steel emissions inventory and set science-aligned targets for producing or sourcing low-emission steel. Tracking progress is essential to ensure accountability and continuous improvement. For steel buyers, engaging with the steelmakers supplying your steel through structured monitoring programs can help evaluate their progress and identify opportunities for further emissions reductions. To build credibility with stakeholders and reinforce your company’s commitment to sustainability, it is crucial to publish annual progress reports following industry standards such as the CDP Reporting Framework. Explore the following resources to drive your progress:

- The World Steel Association’s Climate Action Data Collection: Gathers and analyzes CO2 emissions data from steel producers worldwide. The initiative uses the ISO 14404:2013 standard to ensure consistent and comparable emissions reporting across various sites and processes. The goal is to gain a comprehensive understanding of the steel industry’s carbon footprint and identify opportunities for emissions reductions. The collected data is used to create anonymized industry benchmarks and help companies pinpoint areas for improvement.

- ResponsibleSteel: A global multi-stakeholder program that certifies sustainably produced steel. ResponsibleSteel’s standard sets rigorous criteria across 13 principles, ensuring certified sites meet high environmental and social responsibility standards. ResponsibleSteel certification applies to steelmaking sites and related sites that process raw materials for steelmaking or steel products.

- GHG Protocol’s Corporate Accounting and Reporting Standard: Provides guidance for comprehensive emissions inventory development. Designed for plant managers and site personnel, the Iron and Steel tool offers a step-by-step approach to measure and report GHG emissions from iron and steel manufacturing. It includes spreadsheets for calculating CO₂ and methane emissions from key sources such as stationary combustion (including flares), onsite and offsite metallurgical coke production, Direct Reduced Iron (DRI), traditional iron and steel production, and onsite and offsite lime production.

- CDP Technical Note: Relevance of Scope 3 Categories by Sector: Identifies key Scope 3 categories relevant for the steel sector (p. 46). While Scope 1 and 2 emissions are typically the largest contributors to the sector’s carbon footprint, significant Scope 3 categories should also be measured and reported. These include upstream emissions from the iron ore value chain and fossil fuel inputs, and downstream emissions from manufacturing, use, and disposal of steel.

- Science-Based Targets initiative (SBTi): Provides guidance and tool for steel companies and steel buyers to set near- and long-term net-zero targets for steel emissions. Methodology includes an iron and steel core boundary aligned with the sector’s carbon budget, differentiated pathways based on scrap input, and Scope 3 target covering upstream emissions from fuels.

- RMI Steel GHG Emissions Reporting Guidance: Establishes a standardized methodology for steel companies to report emissions in a way that supports the development of a market for low-embodied-emissions steel, which is produced using methods that reduce GHG emissions across its lifecycle.

Beyond GHG emissions, steel production releases hazardous air pollutants like particulate matter, sulfur dioxide, and nitrogen oxides, which pose serious health risks, including respiratory and cardiovascular diseases, for workers and nearby communities.4 Steelmaking processes also generate waste like slag and wastewater that may contain hazardous chemicals such as heavy metals and acids. Without proper management, these pollutants can contaminate soil and water, harming ecosystems and public health. To mitigate these impacts, steelmakers should implement pollution control technologies to monitor and reduce pollutants and toxicants to ensure better protection of workers and surrounding communities. Environmental Product Declaration (EPD) can be used to measure and track progress on these impacts.

Environmental Product Declaration

EPD is a Type III environmental label developed in accordance with the ISO 14025 standard. While other standards mentioned earlier are company or facility-level standards, EPD serves as a product-level tool to help steelmakers quantify and communicate not only carbon emissions but also other key environmental impacts. This helps reduce regulatory, reputational, and liability risks related to pollution and emissions. EPDs also support market access by meeting requirements in green building certifications (e.g., LEED, BREEAM) and public procurement. By demonstrating credibility and transparency, EPDs build trust with regulators, customers, and investors, while enabling product differentiation and driving innovation in a competitive, low-carbon market. Steelmakers can create EPDs to quantify and report third-party verified data on the carbon footprint and broader environmental impacts of steel products throughout their life cycle. Steel buyers can request EPDs from their suppliers when sourcing steel to inform procurement decisions. Visit the International EPD System for tools and guidance on how to develop, verify, and register EPDs.

Leverage Near-Term Opportunities for Steel Decarbonization

For steelmakers, improving material efficiency and embracing circular economy practices can help curb the growing demand for steel and help your company reduce emissions and costs. Updating and retrofitting industrial plants to become more efficient can contribute to about 20% of cumulative emissions savings5 while also reducing fuel expenditures. Electrification plays a crucial role in decarbonizing energy-intensive industrial processes, with Scrap-Based Electric Arc Furnaces (Scrap EAF) significantly cutting energy use and emissions. Methane emissions from coal mining are a significant contributor to the steel sector’s carbon footprint. While transitioning to green steel processes that eliminate the need for met coal is essential, coal mine methane (CMM) abatement offers a cost-effective way to reduce emissions in the near term. More details on the key actions companies can take now are below:

- Develop Circularity Measures: Steelmakers should focus on improving recycling streams and sorting methods across supply chains to increase scrap collection and recovery and reduce raw materials extraction. Additionally, products should be designed with remanufacturing, refurbishment, and material reuse in mind, with the latter prioritizing designs that minimize contamination (particularly from copper) and enable easier material separation.6 Maximizing recycling opportunities and reducing steel demand across sectors could cut steel production emissions by up to 37% by 2050 compared to a business-as-usual trajectory.7

- Switch to Fossil Free Electricity: The Scrap-Based Electric Arc Furnace (Scrap EAF) method, which uses electricity to melt recycled scrap steel into crude steel, eliminates the need for the processing of iron ore. Compared to the traditional BF-BOF route, Scrap EAF uses only about one-eighth of the energy required and emits less than one-third of the CO2 emissions.5 When powered by renewable energy, emissions from the Scrap EAF process can be reduced to near-zero levels.8 Nearly half of the steelmaking capacity under development is based on EAF technology. This marks a significant increase from 43% in 2023 and 33% in 2022, bringing the IEA’s net zero-aligned target of 37% EAF capacity by 2030 within reach.1

- Improve Energy Efficiency: Existing technologies offer substantial efficiency gains. For example, Coke Dry Quenching – a system that recovers heat from red-hot coke in ovens and repurposes it for power generation or steam production—can reduce energy consumption by up to 40%. Reusing production gases (like coke gas, blast furnace gas, and furnace gas) to generate hot water, steam, and electricity can improve energy efficiency by up to 37%.6 However, global energy efficiency potential is estimated at only 15–20%, as retrofits may not be feasible for older plants.9 Companies should balance near-term efficiency upgrades with long-term investments in emerging decarbonization technologies, especially for plants with long operational lifespans.10 U.S. Steelmakers should take advantage of the Inflation Reduction Act (IRA), which provides financial assistance for industrial facilities to purchase, install, or retrofit technologies that accelerate GHG emission reduction progress to net zero.

- Reduce Methane Emissions From Coal: Methane has roughly 80 times the heat-trapping impact of CO₂ in a 20-year period. Metallurgical (met) coal, a key input for traditional steelmaking processes, is about 2.5 times more methane-intensive than thermal coal, increasing steel’s lifecycle emissions by about 30%. However, most abatable coal mine methane (CMM) emissions could be eliminated at a cost of $20/tCO₂e or less.11 Companies should prioritize sourcing coal from suppliers using CMM abatement or encourage its adoption. For more on CMM solutions, refer to the IEA’s Global Methane Tracker report (p.30). While CMM abatement is a practical way to reduce emissions in the near-term, long-term efforts must focus on transitioning away from met coal entirely. With more than 70% of the global coal-based furnace capacity reaching the end of its life by 2030, companies have a significant opportunity to transition from the traditional BF-BOF route to lower-emission alternatives like Direct Reduced Iron-Electric Arc Furnace (DRI-EAF) technology.

Shift Procurement Toward Low-Emission Steel

Federal and state governments are among the largest buyers of construction materials—collectively purchasing nearly 20% of all steel used in the U.S. Through the State Buy Clean Partnership, 13 states (including California, Colorado, Hawaiʻi, Illinois, Maine, Maryland, Massachusetts, Michigan, New Jersey, New York, Oregon, Washington, and Minnesota) are aligning their procurement policies to prioritize low-carbon infrastructure materials in state-funded projects. Steelmakers that invest in low-emission industrial solutions now will be better positioned to meet this demand and gain a competitive edge in public procurement markets.

Steel buyers, such as auto manufacturers and construction companies, should set public, near-term procurement targets for steel to drive demand for cleaner production methods and engage with suppliers on their decarbonization journey. Participating in green procurement initiatives can further accelerate the transition by facilitating collective action and creating demand for near-zero steel.

According to WRI, while procurement commitments support market growth for existing or near-commercial low-emission steel, additional demand-side tools like Advanced Market Commitments (AMCs) are needed to accelerate the deployment of emerging technologies that deliver deeper emissions cuts. AMCs— or contracts to purchase products once they reach market—can help manufacturers attract the capital needed to scale production. Learn how AMCs can support decarbonization in the steel sector here.

Here are other key resources for action:

- World Economic Forum’s First Movers’ Coalition (FMC): Drives early market demand for breakthrough climate technologies to decarbonize seven key sectors, including steel. FMC leverages corporate purchasing power to accelerate the commercial adoption of near-zero emissions steel. Members commit that at least 10% of their annual steel procurement by 2030 will meet FMC’s near-zero emissions criteria—defined by the IEA as emitting less than 400kg CO2e per tonne of crude steel (0% scrap inputs) and under 50kg CO2e per tonne (100% scrap inputs). This initiative focuses on the commercialization of emerging technologies like hydrogen direct reduction, carbon capture use and storage, and electrolysis-based steel production.

- Climate Group’s SteelZero: a global initiative that brings together companies committed to procuring, specifying, or stocking 100% net zero steel by 2050, with an interim target of sourcing at least 50% lower-emission steel by 2030. SteelZero offers multiple certification pathways through ResponsibleSteel, SBTi, or other related standards. The initiative also provides resources, including a steelmaker commitment database, procurement specification templates, a progress reporting framework, and a project roadmap and supply chain engagement guidance for the construction and property sectors.

- RMI Sustainable Steel Buyers Platform (SSBP): Helps companies turn commitments to low-emission steel into purchasing power. The Platform brings together major buyers—such as automakers, tech firms, and manufacturers—to coordinate collective procurement in North America, ensuring steelmakers secure the offtake agreements needed to finance new low-emissions steel projects. SSBP complements initiatives like SteelZero and the First Mover Coalition by moving beyond pledges to actual demand aggregation, bridging the gap between corporate climate commitments and real market transformation.

Strengthen Industry Collaboration and Advocacy

Engaging with industry coalitions not only helps your company navigate the transition but also supports harmonization of emissions standards, ensuring consistent measurement methods, data reporting, and clear definitions for scopes and benchmarks. This alignment ensures consistency and transparency across global markets. Check out the World Resources Institute’s insights blog here to learn more about key considerations for harmonizing green procurement standards. Participating in industry coalitions also offers opportunities for companies to advocate for stronger policies and remain at the forefront of industry trends and regulatory developments. Explore the following resources to support your efforts:

- Mission Possible Partnership (MPP): A coalition supporting the decarbonization of heavy industry, including steel, through investment and policy advocacy. MPP’s Steel Transition Strategy outlines pathways to reduce emissions in the steel industry with insights from key industry projects and experts. The strategy serves as a reference point for target-setting, informs priority actions, and supports coordinated commitments across the value chain to unlock investment in zero-carbon solutions.

- Industrial Deep Decarbonization Initiative (IDDI): A coalition of governments, companies and organizations working to create a thriving market for near-zero carbon industrial products, starting with steel, cement and concrete. IDDI works to develop standards for low and near-zero emission products and guidelines for emission accounting methodologies. IDDI also provides publicly accessible data, research and tools to support target-setting, reporting and industry benchmarking comparisons, as well as training and knowledge sharing to equip manufacturers with the expertise needed for the global race to net zero.

- The Climate Club: An open forum for collaboration on accelerating climate action in industrial decarbonization. Members exchange assessments and best practices on ambitious, transparent mitigation policies, aiming to build a shared understanding of their effectiveness and economic impact. Its Global Matchmaking Platform supports private sector engagement by strengthening capacity, fostering peer learning, and identifying key gaps and challenges in accessing finance for industry decarbonization.

- WRI’s Forum for International Green Industry (FIGI): Tracks international collaboration on industrial decarbonization, with a focus on green cement, steel, hydrogen and more. The Forum facilitates the exchange of information and increased communication and coordination among international initiatives and the policymaking and industry landscape. Subscribe to the FIGI newsletter or view past editions here.

Footnotes

- WEF | Net Zero Industry Tracker 2024

- Global Energy Monitor | Pedal to the Metal 2023

- World Resources Institute | State of Climate Action Report 2023

- Industrious Labs | New Report Unveils Alarming Health Costs of U.S. Coal-Based Steelmaking

- IEA | Iron and Steel Technology Roadmap

- Energy Transitions Commissions | Mission Possible Sectoral Focus: Steel

- Statista | Steel Emissions Intensity by Production Route

- World Economic Forum | Net Zero Industry Tracker 2024

- McKinsey & Company | Decarbonization of industrial sectors: The next frontier

- World Resources Institute | Shifts to Decarbonize Industry

- EDF | Coal Mine Methane: An Overview for Investors