Decarbonize Cement Production

Environmental Defense Fund

Cement producers and buyers can advance the industry's transition by seizing near-term opportunities, increasing demand for low-carbon cement, adopting technologies like carbon capture, utilization, and storage (CCUS), and fostering greater collaboration and advocacy across the sector.

The cement industry is responsible for about 6% of global CO2e emissions.1 85% of emissions come from the production of clinker in the preheater/precalciner and kiln, of which 51% are from the chemical calcination process and 34% are from the combustion of fossil fuels used to heat cement kilns to temperatures as high as 1450°C.2

Global cement production capacity has increased by 30% in the past decade and is expected to grow by 14% by 2030, with an additional 22% increase by 2050,3 driven by global population growth, urbanization and infrastructure development needs in Southeast Asia, Latin America, and Africa.4 The World Resources Institute (WRI)’s State of Climate Action report estimates that, to decarbonize the economy, the carbon intensity of global cement production needs to decline by about 45% by 2030 compared to 2020.5

Cement producers in the U.S. can play a crucial role in driving the transition to a low-carbon cement industry by improving energy efficiency, switching to fuels that are less carbon-intensive, reducing clinker content in cement and implementing technologies such as carbon capture and utilization and storage. Buyers of cement can drive demand by specifying low-carbon cement in their construction projects, setting clear sustainability targets, and supporting green procurement initiatives. Cement producers and buyers should also collaborate, invest in innovation, and advocate for policies that support the transition. The following steps outline how your company can contribute to this shift.

Understand Your Cement Emissions Footprint and Set Goals

Companies can start by conducting a cement emissions inventory. This baseline assessment helps identify emissions hotspots and opportunities for reduction, serving as the foundation for setting targets and tracking progress over time. The following resources can help guide you in this step:

- GHG Protocol’s Corporate Accounting and Reporting Standard: Provides guidance for comprehensive emissions inventory development. The sector-specific calculation tools for cement reflect best-practice methods and include worksheets for estimating GHG emissions from cement manufacture.

- CDP Technical Note: Relevance of Scope 3 Categories by Sector: Identifies key Scope 3 categories relevant for the cement sector, with the majority fall under emissions from purchased goods and services, fuel and energy-related activities and upstream transportation and distribution (p. 13). WBSCD’s Cement Sector Scope 3 GHG Accounting and Reporting Guidance provides a standardized approach for cement companies to calculate and report these indirect emissions.

- Global Cement and Concrete Association (GCCA): Provides Sustainability Guidelines for monitoring and reporting emissions from cement production, outlining relevant protocols and defining the Key Performance Indicators (KPIs) that companies can use to benchmark performance. The GCCA also provides guidelines on setting targets and measuring and reporting progress on other areas, including health and safety, social responsibility, environment and nature and the circular economy. The GCCA’s Getting the Numbers Right (GNR) is a key tool for tracking and reporting sustainability progress in the cement industry. Independently managed and externally verified, the GNR database collects CO2 and energy performance data from cement producers worldwide. Cement companies also have access to the Cement CO2 and Energy Protocol spreadsheet and online manual to support accurate and practical reporting.

- Science-Based Targets initiative (SBTi): Provides guidance and tool for cement producers and users to set near- and long-term science-aligned emissions reduction targets. It includes guidance on handling cement- and concrete-specific processes, sector-specific GHG accounting criteria, practical examples for different types of companies, and instructions for submitting targets for validation.

Beyond GHG emissions, cement plants are major sources of air pollutants—including particulate matter, sulfur dioxide, nitrogen oxide and carbon monoxide—which worsen air quality and contribute to adversary environmental impacts such as ground-level ozone and acid rain, and are linked to a range of serious health risks such as respiratory and cardiovascular diseases, as well as harmful effects on the central nervous system.6 Waste incineration releases toxic pollutants—like benzene, PFAS, dioxins, and heavy metals—that contaminate air, water and food, exposing nearby communities through breathing, drinking and eating.7 Cement producers should adopt advanced monitoring, reporting and verification practices to track emissions and pollutants and support policies that require transparent Environmental Product Declarations (EPD).

Environmental Product Declarations

EPD is a Type III environmental label developed in accordance with the ISO 14025 standard. While other standards mentioned earlier are company or facility-level standards, EPD serves as a product-level tool to help cement companies quantify and communicate not only carbon emissions but also other key environmental impacts. This helps reduce regulatory, reputational, and liability risks related to pollution and emissions. EPDs also support market access by meeting requirements in green building certifications (e.g., LEED, BREEAM) and public procurement. By demonstrating credibility and transparency, EPDs build trust with regulators, customers, and investors, while enabling product differentiation and driving innovation in a competitive, low-carbon market. Cement buyers, including construction companies and real estate developers, can request EPDs from their suppliers to evaluate the full environmental footprint of cement products and inform procurement decisions. Visit the International EPD System for tools and guidance on how to develop, verify, and register EPDs.

Leverage Near-Term Opportunities for Cement Decarbonization

Three major near-term areas for cement decarbonization involve the calcination process: clinker substitutes, alternative kiln fuels, and efficiency measures. Each of these areas has solutions that are economically feasible and technologically ready to deploy. Aggressively scaling up measures in these three areas could reduce emissions by approximately 30% by the early 2030s and 40% by 2050, while generating over $1 billion in annual savings for the industry if implemented at scale.2

Utilize Clinker Substitutes

Clinker substitutes, or supplementary cementious materials (SCMs), replace a large share of clinker in the final cement mix, reducing the amount of carbon-intensive clinker that needs to be produced. Scaling up the use of blended cements that meet current standards could cut emissions by about 20-25% by 2030.2

Below are the key takeaways on clinker substitute materials, including their carbon abatement potential, typical substitution rates, cost per metric ton, and deployment costs from the U.S. Department of Energy’s Pathways to Commercial Liftoff report, with application insights from the Global Concrete and Cement Association:

Clinker substitution offers significant cost-saving opportunities as most substitutes are much cheaper than clinker, which typically costs $60–70/metric ton with fuel and power. However, substitution potential depends on regulatory limits, regional availability, and processing requirements.

Traditional substitutes like ground limestone, fly ash, and steel slag are already commercially used, though typically at limited substitution rates due to regulatory caps and material availability.

- Ground limestone is widely available, requires minimal processing, and is relatively inexpensive, typically costing between $5 and $10/metric ton. However, its use is often capped at 15% of a cement blend under current standards, resulting in about 10% less emissions compared to ordinary Portland cement.

- Fly ash, which typically costs $40–60/metric ton, can be used to replace up to 35% of clinker. Its availability is declining, however, due to the retirement of coal-fired power plants, which have historically produced it as a byproduct. Using fly ash as a substitute material can cut emissions by 32% compared to ordinary Portland cement. However, fly ash blends are slower to set and cure, so they are less suitable for precast concrete.

- Steel slag, or Ground Granulated Blast-furnace Slag (GGBS), costs $40–60/metric ton. It can replace up to 95% of clinker, though more typical substitution rates are between 30% and 40%. Slag-based blends reduce emissions by roughly 42% compared to ordinary Portland cement. However, steel production is geographically variable, so slag is not readily available in Europe and North America. In addition, slag is already widely used—about 90% of available material is utilized— and its long-term availability may be affected as traditional blast furnace steelmaking is phased out. Slag-based blends also set and cure more slowly, making them less suitable for precast concrete.

Emerging substitutes like calcined clays and natural pozzolans have demonstrated strong technical performance and emissions reduction potential, but are still deployed at a limited scale. These substitutes cost between $10-35/metric ton, can replace 30-40% of the clinker mix and up to 50% for Limestone Calcined Clay Cement (LC3), and cut emissions by 30-40% compared to ordinary Portland cement.

- Clays are commonly found at cement plants, though expanding existing quarries may be necessary. Calcined clay, along with ground limestone, creates LC3. According to the Rocky Mountain Institute (RMI), LC3 offers a near-term, cost-effective solution for cement decarbonization, with analysis across global regions showing rapid payback periods and substantial operational savings.8 In 2024, the U.S. Department of Energy committed major funding to six LC3 projects aiming to cut 4 million metric tons of CO2 emissions annually.9 Key efforts include National Cement’s net-zero plant in California, Roanoke Cement’s facility in Virginia, and Summit Materials’ four calcination sites across Maryland, Georgia, and Texas.

- Natural pozzolans are widely available in some regions. Though natural pozzolan-based blends lack the same early strength as ordinary Portland cement and other blends, their long-term strength and resilience is superior, reducing maintenance requirements and lengthening the life of concrete buildings.

Plants must secure nearby sources of substitute materials and may need to invest in material processing, storage and transport. Despite variability in site-specific deployment costs, clinker substitution remains economically favorable in many cases.8

In choosing clinker substitutes, cement producers should consider the potential upstream impacts of the raw materials, such as the surface and underground mining necessary for limestone extraction or the marine and human health impacts involved in processing GGBS. The processing of some clinker substitute materials may increase GHG and particulate matter emissions in the communities in which they are produced and decrease emissions where they are utilized.

Switch to Alternative Fuels

Fossil fuels account for 90% of thermal energy needs in cement production, with coal and petroleum coke making up the majority.3 Switching to lower-carbon alternative fuels, such as biomass and waste-derived sources, for heating cement kilns can deliver 5–10% emission reductions by 2030. Waste-based fuels like tires, oils, and plastics are already in use and offer modest cost advantages due to their high heat content and the economic incentive of high waste disposal fees, but deployment is constrained by supply. Biomass fuels also offer low-cost emissions reduction potential, but their availability is limited, particularly for high-quality feedstocks like fruit stones and nut shells.2

However, burning these alternative fuels can result in emissions of sulfur dioxide, nitrogen oxides, and other hazardous pollutants, posing significant health risks for nearby communities that are often low-income and overburdened by pollution.10 Given the relatively limited carbon abatement potential of most alternative fuels, cement producers should prioritize minimizing non-CO₂ pollutants when selecting these fuel solutions.

Implement Efficiency Measures

Efficiency measures, such as process control, improved internal transport systems, and high-efficiency motors and fans, could reduce emissions by 2-5% by 2030 without increasing product costs and potentially leading to modest savings per metric ton of cement.2

Reducing concrete demand through efficiency in design and construction can cut cumulative emissions by 22% by 2050 without compromising safety or durability. Building owners, designers, and concrete buyers can leverage various strategies, such as topology optimization, structural solutions (such as precasting, post-tensioned structures, and voids, coffers, or fill), lean design, reuse of concrete elements, extension of building lifespans and alternative materials in construction.11 Cement-based construction 3D printing also has the potential to reduce GHG emissions both in the production of printable cementitious mixtures and their use in new constructions.12

Shift Procurement Toward Low-Emission Cement

Federal and state governments are among the largest buyers of construction materials—collectively purchasing nearly 50% of all cement used in the U.S. Through the State Buy Clean Partnership, 13 states (including California, Colorado, Hawaiʻi, Illinois, Maine, Maryland, Massachusetts, Michigan, New Jersey, New York, Oregon, Washington, and Minnesota) are aligning their procurement policies to prioritize cleaner infrastructure materials in state-funded projects. Cement producers that invest in low-emissions industrial solutions now will be better positioned to meet this demand and gain a competitive edge in public procurement markets.

Cement buyers, such as construction companies and real estate developers, should set public, near-term procurement targets for low-carbon cement to drive demand for cleaner production methods and engage with suppliers on their decarbonization journey. Participating in green procurement initiatives can further accelerate the transition by facilitating collective action and creating demand for low-carbon cement.

According to WRI, while procurement commitments support market growth for existing or near-commercial low-carbon cement, additional demand-side tools like Advanced Market Commitments (AMCs) are needed to accelerate the deployment of emerging technologies that deliver deeper emissions cuts. AMCs—contracts to purchase products once they reach market—can help manufacturers attract the capital needed to scale production. Learn how AMCs can support decarbonization in the cement sector here.

Here are a few key initiatives that focus on cement decarbonization:

- Climate Group’s Concrete Zero: A global initiative that brings together companies committing to using 100% net zero concrete by 2050, with interim targets of 30% low-emission concrete by 2025 and 50% by 2030. The initiative offers a collaborative platform to share knowledge, develop practical guidance, exchange best practices, and engage in technical workstreams focused on improving transparency, carbon measurement, and advancing policy progress.

- World Economic Forum’s First Movers’ Coalition (FMC): Drives early market demand for breakthrough climate technologies to decarbonize seven key sectors, including cement and concrete. FMC leverages corporate purchasing power to accelerate the commercial adoption of near-zero emissions cement and concrete. Members commit to purchasing 10% of their cement and concrete per year as near zero by 2030 through AMCs. This initiative focuses on the deployment of breakthrough cement and concrete manufacturing technologies like carbon capture use and storage, clinker substitution, and alternative cement chemistries based on binders from alternative production pathways.

- The Center for Green Market Activation (GMA) and Rocky Mountain Institute (RMI) are launching an initiative to drive investment in low-emission cement and concrete, aiming to cut embodied emissions in the built environment. Phase one will develop a credible measurement and book-and-claim system; phase two will establish a collective procurement model.

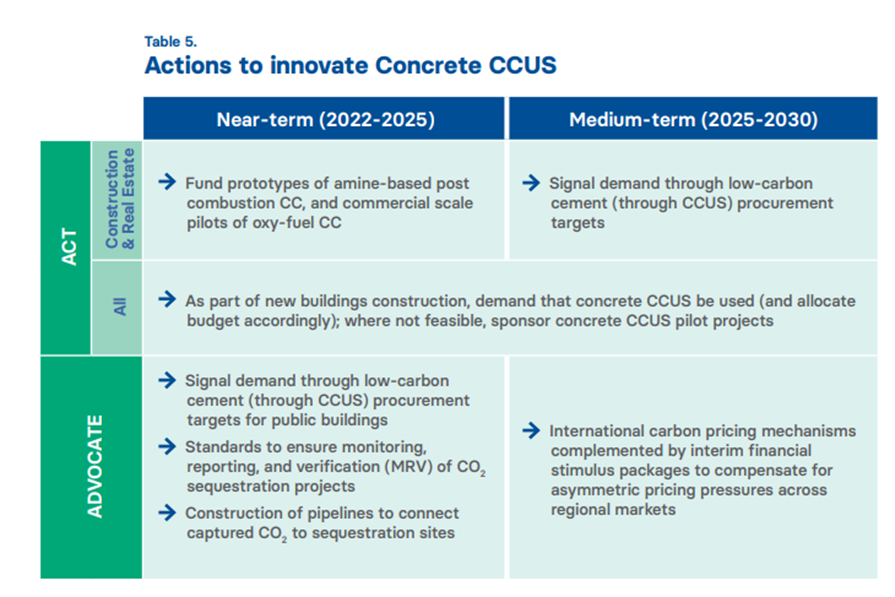

Innovate Concrete Carbon Capture and Utilization & Storage

Carbon Capture and Utilization & Storage (CCUS) involves capturing a portion of CO2 emitted during cement manufacturing through chemical absorption, calcium looping and oxy-fuel combustion and injecting it into fresh concrete during production as a form of storage. These methods remain in prototype of early demonstration phase, with few commercial installations and no proven cost-competitive models or full capture rates.2

CCUS adds significant cost to cement production, driven by upfront capital costs, high operating costs from fuel and power use and potentially high CO₂ transportation and storage costs. Even with the Inflation Reduction Act’s 45Q tax credit, capturing 95% of emissions can add $25–55 per metric ton of cement (a 20–40% premium). Without 45Q, costs rise to $85–120 per metric ton (70–90% premium). Breaking even would require major cost reductions or new revenue streams.2

It is important that proper guardrails are established for CCUS deployment. Ensuring captured CO2 is safely and permanently stored requires extensive technical expertise in selecting, monitoring, and maintaining storage sites to demonstrate secure and long-term storage. Without clear regulatory standards, rigorous oversight of the monitoring, reporting and verification of “sequestered” volumes in utilized CO2 in cement production is equally important.

CCUS projects should not overlook nearby communities directly affected by industrial pollution, who receive no compensation nor have a say in the management of CCUS externalities. Companies should prioritize CCUS projects that meaningfully engage local communities and provide solutions to ensure protection of the neighborhoods surrounding their operations.

Strengthen Industry Collaboration and Advocacy

Engaging with industry coalitions not only helps your company navigate the transition but also supports harmonization of emissions standards, ensuring consistent measurement methods, data reporting, and clear definitions for scopes and benchmarks. This alignment ensures consistency and transparency across global markets. Check out the World Resources Institute’s insights blog here to learn more about key considerations for harmonizing green procurement standards. Participating in industry coalitions also offers opportunities for companies to advocate for stronger policies and remain at the forefront of industry trends and regulatory developments. Explore the following resources to support your efforts:

- Mission Possible Partnership (MPP): A coalition supporting the decarbonization of heavy industry, including concrete and cement, through investment and policy advocacy. MPP’s Concrete and Cement Sector Transition Strategy outlines an industry-backed net zero roadmap for the concrete and cement sector. The strategy serves as a reference point for target-setting, informs priority actions, and supports coordinated commitments across the value chain to unlock investment in zero-carbon solutions.

- Industrial Deep Decarbonization Initiative (IDDI): A coalition of governments, companies and organizations working to create a thriving market for near-zero carbon industrial products, starting with steel, cement and concrete. IDDI works to develop standards for low and near-zero emission products and guidelines for emission accounting methodologies. IDDI also provides publicly accessible data, research and tools to support target-setting, reporting and industry benchmarking comparisons, as well as training and knowledge sharing to equip manufacturers with the expertise needed for the global race to net zero.

- The Climate Club: An open forum for collaboration on accelerating climate action in industrial decarbonization. Members exchange assessments and best practices on ambitious, transparent mitigation policies, aiming to build a shared understanding of their effectiveness and economic impact. Its Global Matchmaking Platform supports private sector engagement by strengthening capacity, fostering peer learning, and identifying key gaps and challenges in accessing finance for industry decarbonization.

- WRI’s Forum for International Green Industry (FIGI): Tracks international collaboration on industrial decarbonization, with a focus on green cement, steel, hydrogen and more. The Forum facilitates exchange of information and increased communication and coordination among international initiatives and the policymaking and industry landscape. Subscribe to the FIGI newsletter or view past editions here.

Footnotes

- WEF | Net Zero Industry Tracker 2024

- U.S. Department of Energy | Pathways to Commercial Liftoff: Low-Carbon Cement

- IEA | Cement

- IEA | Net Zero by 2050

- World Resources Institute | State of Climate Action Report 2023

- EPA | Cement Manufacturing Enforcement Initiative

- NRDC | Cut Carbon and Toxic Pollution, Make Cement Clean and Green

- RMI | The Business Case for LC3

- U.S. Department of Energy | Industrial Demonstrations Program Selected and Awarded Projects: Cement and Concrete

- Global Efficiency Intelligence| Emissions Impacts of Alternative Fuels Combustion in the Cement Industry

- Gangotra, A. et al. | 3D printing has untapped potential for climate mitigation in the cement sector